student loan debt relief tax credit 2020

The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were.

What Are The Pros And Cons Of Student Loan Forgiveness

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Maryland offers the Student Loan Debt Relief Tax Credit for students who have incurred at least 20000 in student loan debt and have a remaining balance of at least 5000.

There are many debt relief options that are available to help you reduce or even get rid of your student debt in a consistent and logical manner. 15 to apply for a Student Loan Debt Relief Tax. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate.

Now privately held federal student loans must have been consolidated before September 29 in order to be eligible for the debt relief. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code.

If the credit is more than the taxes you would otherwise owe you will receive a tax. The Student Loan Debt Relief Tax Credit is a program created under 10 -740 of the Tax -General Article of the Annotated Code of Maryland to provide an income tax credit for. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

Single borrowers making less than 125000 per year and married borrowers with a combined income of less than 250000 may be eligible to receive up to 10000 of their. Who may apply. In Indiana for example the state tax rate is 323.

Complete the Student Loan Debt. Borrowers can opt out of the program. Were eligible for in-state tuition.

The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. Will have maintained residency within the state of Maryland for the 2020 tax year Have. Complete the Student Loan Debt Relief Tax Credit application.

Eligible people have until Sept. Maryland r esidents looking to claim student loan debt relief must do so in less than two weeks. If the credit is more than the taxes you would otherwise owe you will receive a tax.

An official website of the State of Maryland. Complete the Student Loan Debt Relief Tax Credit application. Student Debt Relief.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Who wish to claim the Student Loan Debt Relief Tax Credit. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings.

Student Loans In The United States Wikipedia

Income Based Repayment Of Student Loans Plan Eligibility

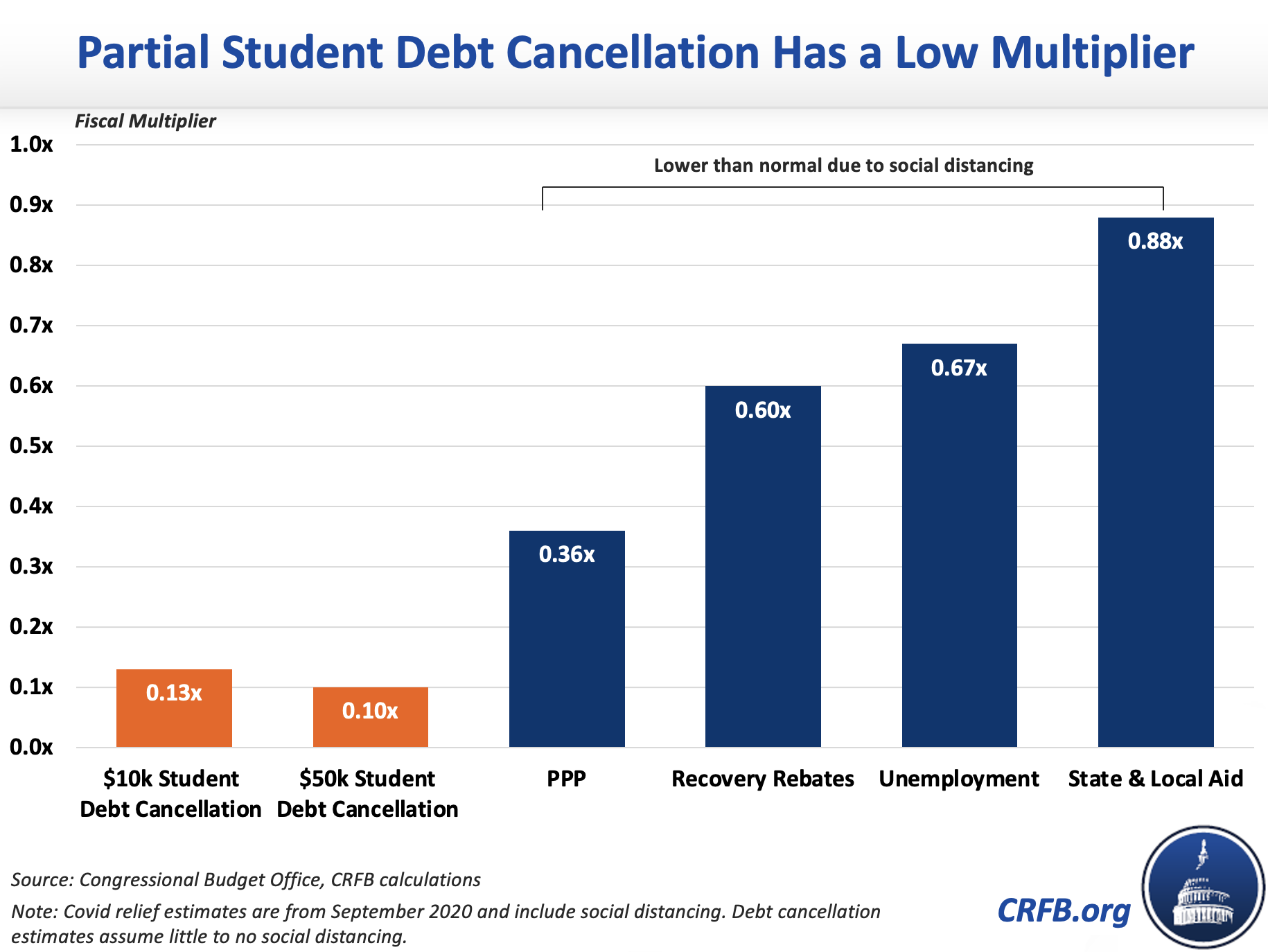

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Who Qualifies For Student Loan Forgiveness Under Biden S Plan

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Key Information On Federal Student Debt Relief Programs News Center

:max_bytes(150000):strip_icc()/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)

Private Vs Federal College Loans What S The Difference

One Time Student Loan Debt Relief

Student Loan Debt Forgiveness Faq Who Gets Relief How Much Is Canceled And When Will It Happen Cnet

After President Biden Cancels Student Debt Center For American Progress

2022 Student Loan Forgiveness Program H R Block

How To Manage Your Student Loan Debt Solutions Tips

Will Student Loan Repayment At Long Last Be A Game Changer

Who Benefits From Student Debt Cancellation

Debt Relief And The Cares Act Which Borrowers Benefit The Most Liberty Street Economics

Conservatives Are In A Legal Battle To Stop Biden S Student Loan Forgiveness Npr

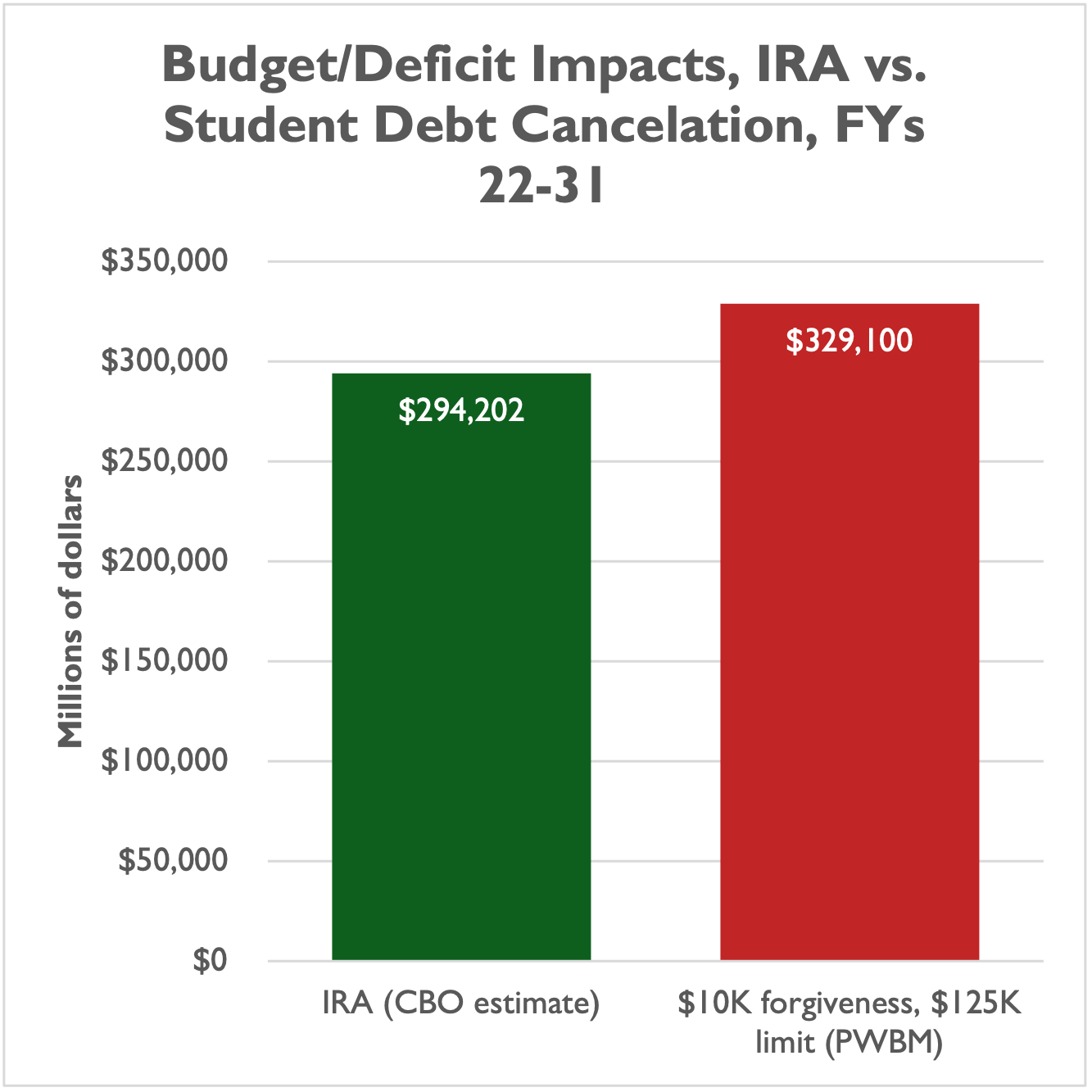

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way

Biden S Student Loan Forgiveness Plan Your Questions Answered The New York Times